CAPS SICAV

Carlyle AlpInvest Private Markets Secondaries

About CAPS SICAV

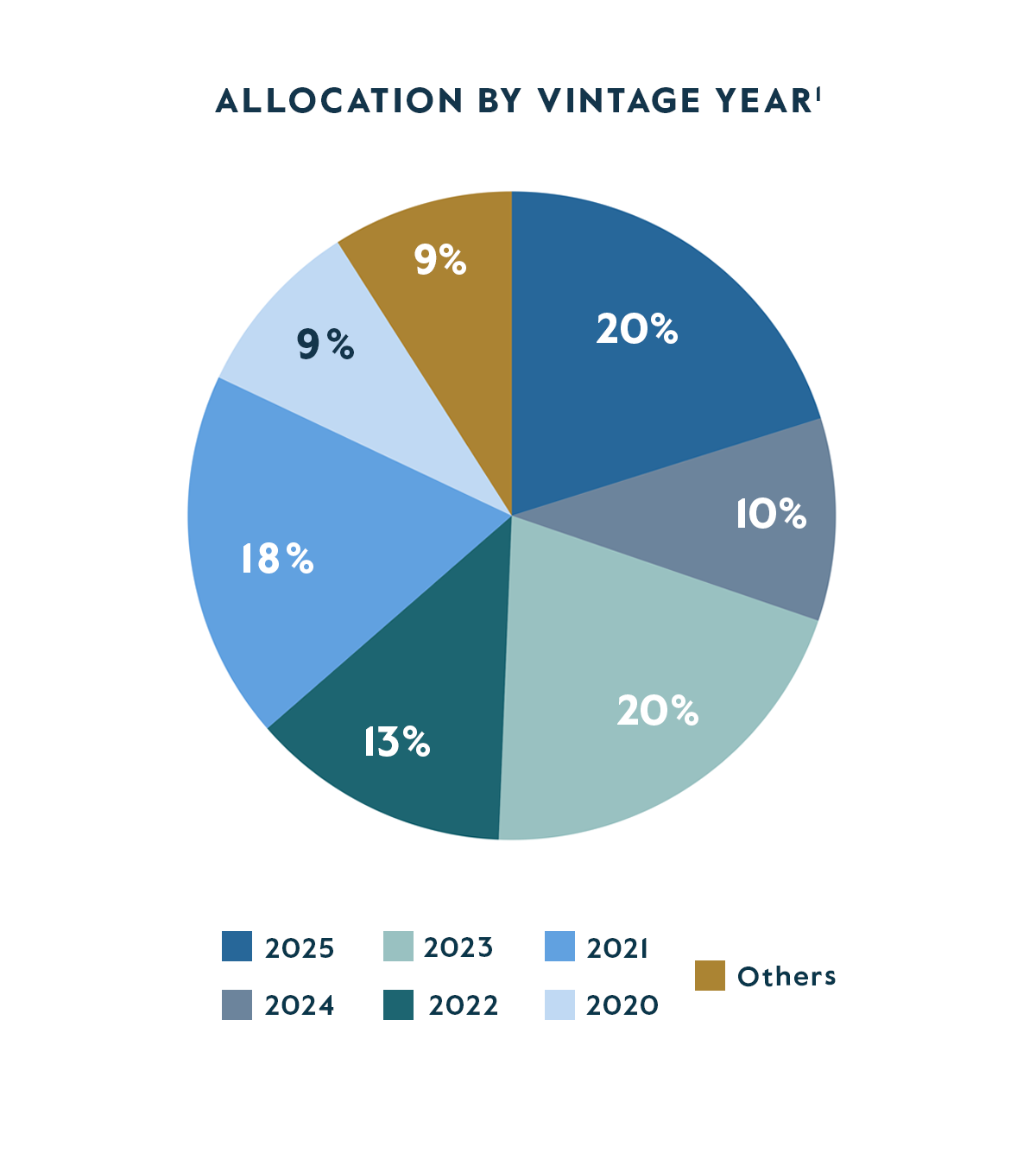

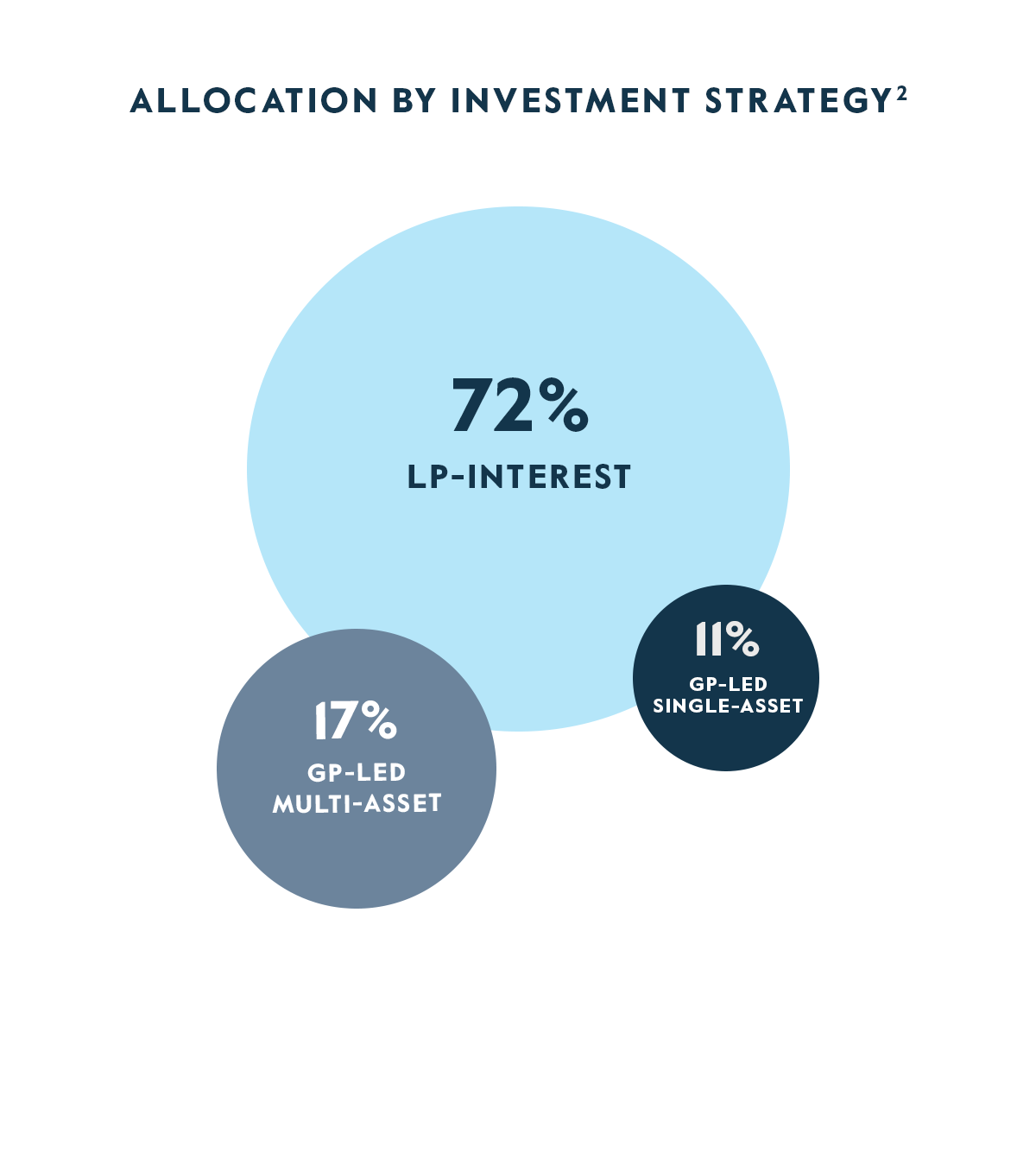

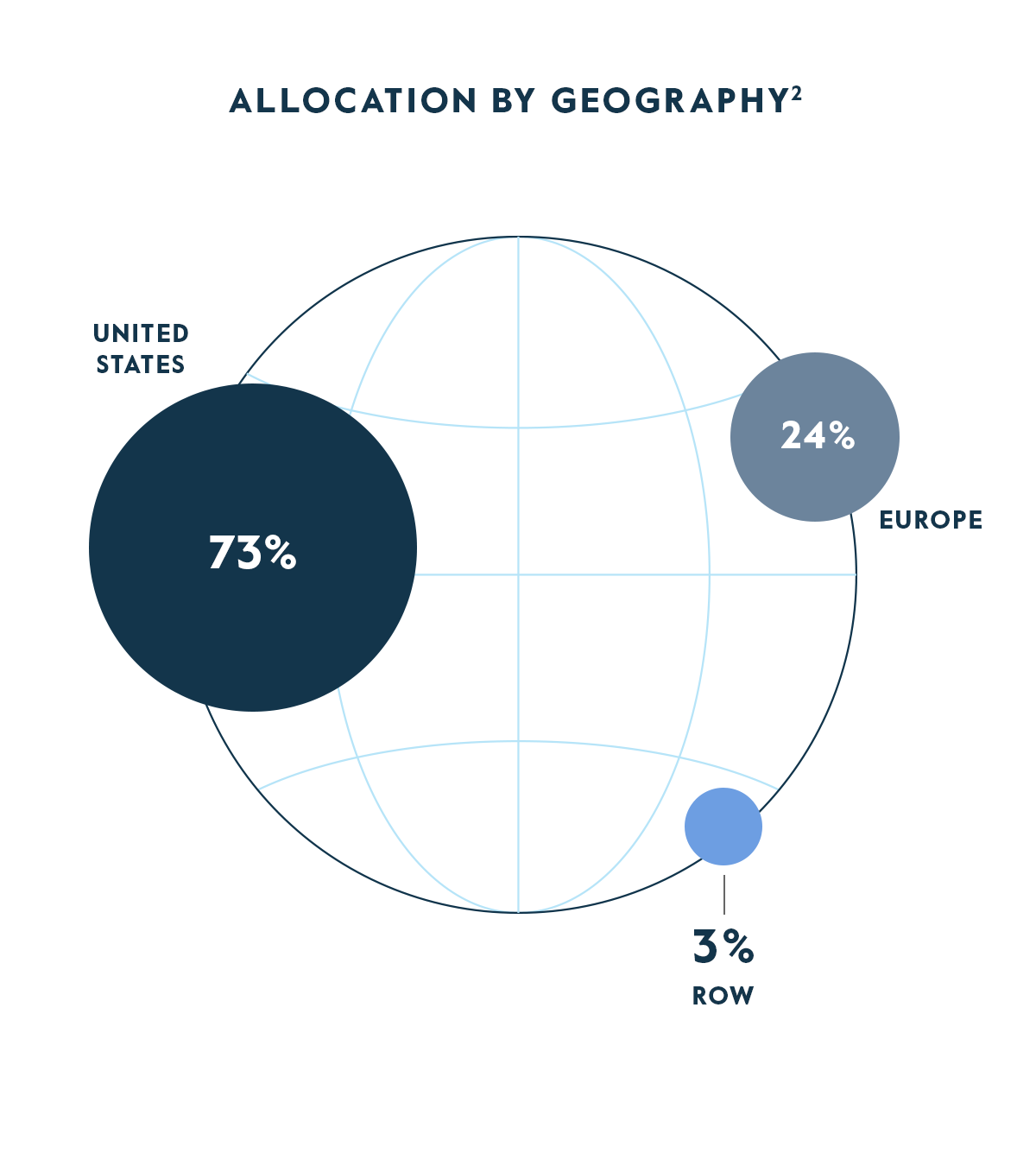

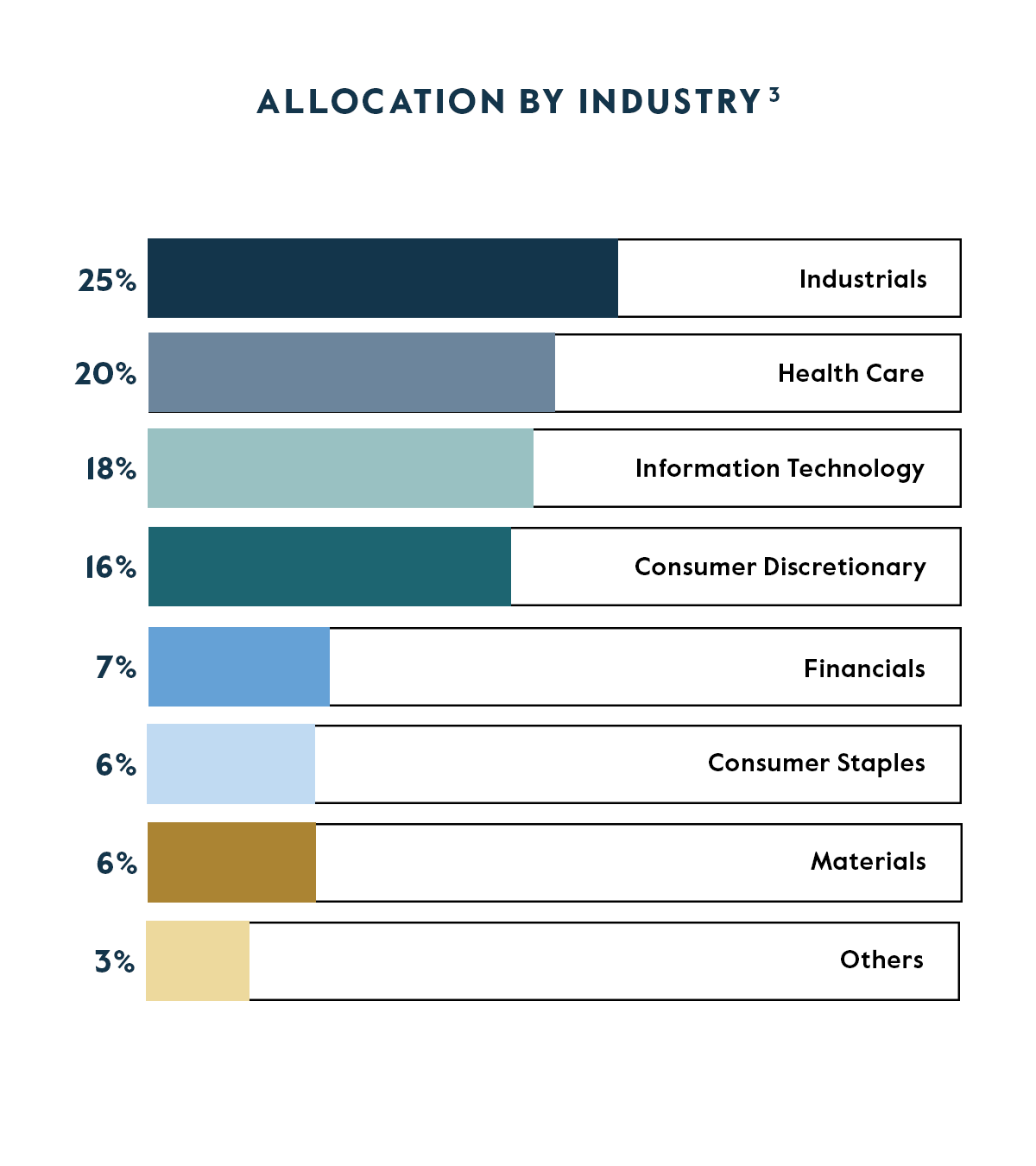

Carlyle AlpInvest Private Markets Secondaries, a sub-fund of Carlyle AlpInvest Private Markets SICAV-UCI Part II, (“CAPS SICAV” or the “Fund”) is an evergreen fund that aims to provide immediate, diversified, and continuous access to private market secondaries. The fund offers monthly subscriptions and quarterly redemptions, on the basis set out in its offering document. CAPS SICAV leverages the full strength of Carlyle AlpInvest’s global secondaries platform and seeks to deliver a well-diversified portfolio by fund, vintage year, company, geography, and industry.

Over the course of more than 25 years, Carlyle AlpInvest has committed more than $108BN to investments as of June 30, 2025.

The Fund materials below must be preceded or accompanied by a prospectus, which is the exclusive offering document for CAPS SICAV. By proceeding, you acknowledge you have reviewed the prospectus. If not, a prospectus can be requested via email. Please review the following summary of risk factors, as well as the prospectus, for a full list of risks associated with investing in the Fund before making any investment decision.

Introduction to the Secondaries Market

with Chris Perriello

Intro to CAPS SICAV

with Chris Perriello

History of Carlyle AlpInvest

with Ruulke Bagijn

CAPS SICAV Portfolio Details

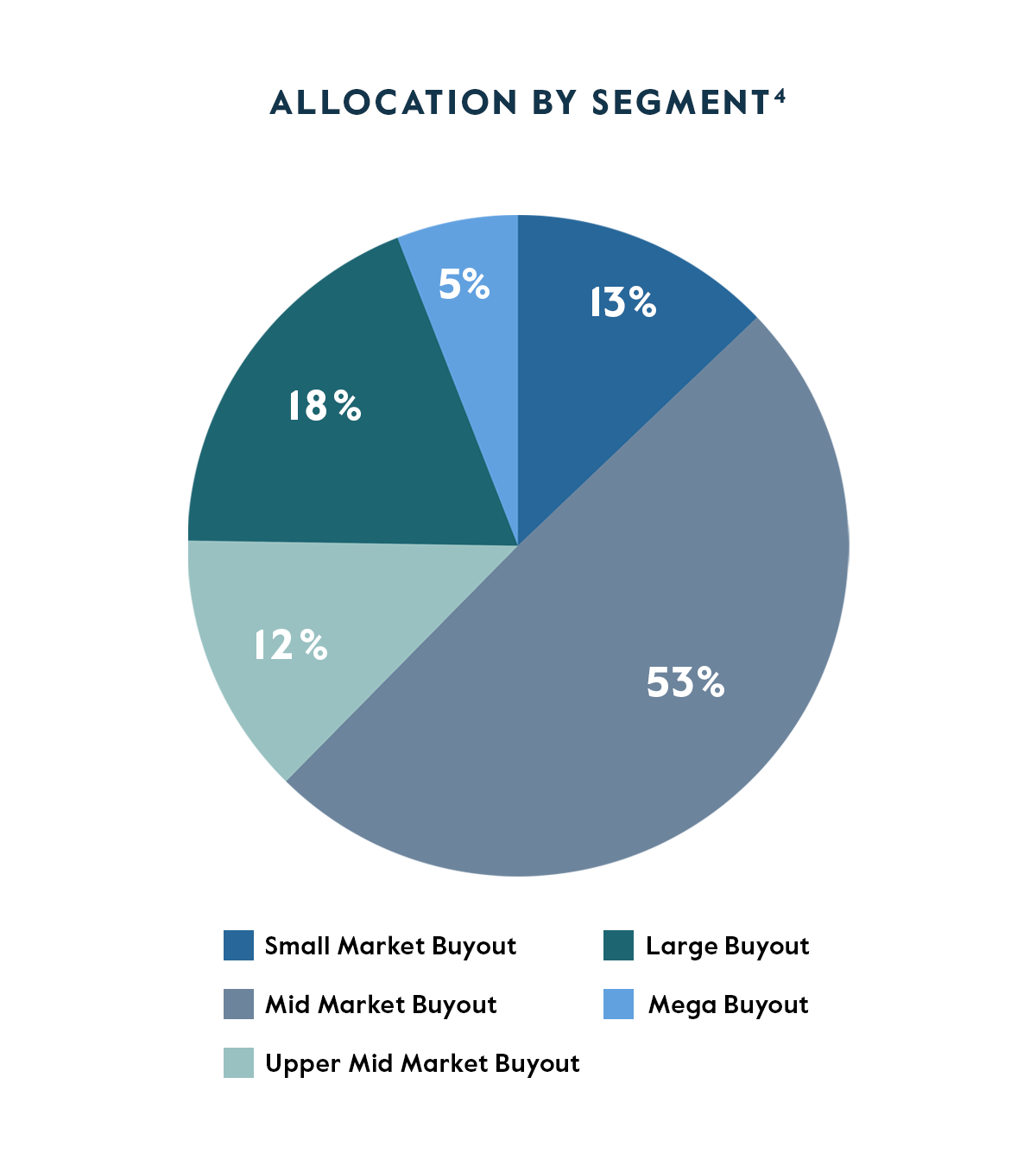

Information as of September 30, 2025 unless otherwise noted. For illustrative purposes only. Please refer to the Risk Factors in the Important Information section. No assurance is given that market trends will continue. There can be no assurance that any portfolio construction objective can be achieved or that any such portfolio will be profitable. References to sponsors are not and should not be construed as a recommendation of any particular GP. There can be no assurance that AlpInvest will be able to invest in similar opportunities in the future. Numbers may not sum due to rounding. Pie charts shown are based on FMV. 1. For LP-Interest Secondaries, the UPC Vintage Year is the underlying company’s initial investment year. For GP-Led Secondaries, it is the year of AlpInvest’s acquisition. 2. Based on underlying secondary fund investments. Europe refers to Western Europe only 3. Based on underlying portfolio companies. 4. For GP-Led Secondaries, “Buyout" classifications are based on the entry TEV. Small <$500M, Mid $500M-1.5B, Upper Mid $1.5- 2.5B, Large $2.5B-10B and Mega > $10B. For LP-Interest Secondaries, "Buyout" classifications are based on the size of the fund: Small <$1B, Mid $1-5B, Upper Mid $5-10B, Large $10-15B and Mega > $15B. For GP-Led Secondaries, the typical profile of a “Growth-Equity” company includes minimal or no leverage at entry and utilizes growth investments to optimize sales efforts, capitalize on growth avenues and drive margin improvements through scalable initiatives, positioning the Company for a full exit through a sale or IPO. “Growth equity” for LP-Interest Secondaries is defined as funds targeting more than 50% of the fund size for companies that have potential for scalable and renewed growth.

Materials

Key Investor Documents (KIDs)

| Class | Currency | Type of Share |

| Class CG - USD - Dutch | USD | Accumulating |

| Class N - USD - Dutch | USD | Accumulating |

| Class NA - USD - Dutch | USD | Accumulating |

| Class R - USD - Dutch | USD | Accumulating |

| Class RA - USD - Dutch | USD | Accumulating |

| Class UK - USD - Dutch | USD | Accumulating |

| Class UKA - USD - Dutch | USD | Accumulating |

| Class | Currency | Type of Share |

| Class CG - USD - English | USD | Accumulating |

| Class N - USD - English | USD | Accumulating |

| Class NA - USD - English | USD | Accumulating |

| Class R - USD - English | USD | Accumulating |

| Class RA - USD - English | USD | Accumulating |

| Class UK - USD - English | USD | Accumulating |

| Class UKA - USD - English | USD | Accumulating |

| Class | Currency | Type of Share |

| Class CG - USD - Italian | USD | Accumulating |

| Class N - USD - Italian | USD | Accumulating |

| Class NA - USD - Italian | USD | Accumulating |

| Class R - USD - Italian | USD | Accumulating |

| Class RA - USD - Italian | USD | Accumulating |

| Class UK - USD - Italian | USD | Accumulating |

| Class UKA - USD - Italian | USD | Accumulating |

| Class | Currency | Type of Share |

| Class CG - USD - German | USD | Accumulating |

| Class N - USD - German | USD | Accumulating |

| Class NA - USD - German | USD | Accumulating |

| Class R - USD - German | USD | Accumulating |

| Class RA - USD - German | USD | Accumulating |

| Class UK - USD - German | USD | Accumulating |

| Class UKA - USD - German | USD | Accumulating |

Contact Us

For additional information, please reach out to:

Americas: [email protected]

EMEA: [email protected]

APAC: [email protected]